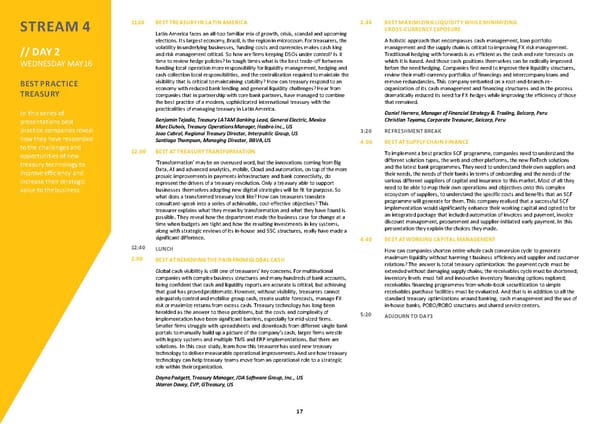

11:20 BESTTREASURYINLATINAMERICA 2.40 BESTMAXIMIZINGLIQUIDITYWHILEMINIMIZING STREAM4 Latin America faces an all-too familiar mix of growth, crisis, scandal and upcoming CROSS-CURRENCYEXPOSURE elections. Itslargesteconomy,Brazil,istheregioninmicrocosm.Fortreasurers,the A holistic approach that encompasses cash management, loan portfolio // DAY 2 volatility in underlying businesses, funding costs and currencies makes cash king management and the supply chain is critical to improving FX risk management. and risk management critical. So how are firms keeping DSOs under control? Is it Traditional hedging with forwards is as efficient as the cash and rate forecasts on WEDNESDAY MAY16 time to review hedge policies? In tough times what is the best trade-off between which it is based. And those cash positions themselves can be radically improved handing local operation more responsibility for liquidity management, hedging and before theneed hedging.Companies first need toimprovetheirliquidity structures, cashcollection local responsibilities, and thecentralization requiredtomaintain the review their multi-currency portfolios of financings and intercompany loans and BESTPRACTICE visibility that is critical to maintaining stability? How can treasury respond to an remove redundancies. This company embarked on a root-and-branch re- TREASURY economy with reduced bank lending and general liquidity challenges? Hear from organization of its cash management and financing structures and in the process companies that in partnership with core bank partners, have managed to combine dramatically reduced its need for FX hedges while improving the efficiency of those the best practice of a modern, sophisticated international treasury with the that remained. In this series of practicalities of managing treasury inLatinAmerica. Daniel Herrera, Manager of Financial Strategy & Trading, Belcorp, Peru presentations best Benjamin Tejadio, Treasury LATAM Banking Lead, General Electric, Mexico Christian Toyama, Corporate Treasurer, Belcorp,Peru practice companiesreveal Marc Dubois, Treasury Operations Manager, Hasbro Inc.,US 3:20 REFRESHMENTBREAK how they have responded Joao Cabral, Regional Treasury Director, Interpublic Group, US Santiago Thompson, Managing Director, BBVA,US 4.00 BESTATSUPPLYCHAINFINANCE to the challenges and 12.00 BESTATTREASURYTRANSFORMATION To implement a best practice SCF programme, companies need to understand the opportunities of new different solution types, the web and other platforms, the new FinTech solutions treasury technology to ‘Transformation’ may be an overused word, but the innovations coming from Big andthelatestbankprogrammes.Theyneedtounderstandtheirownsuppliersand improve efficiency and Data,AIandadvancedanalytics,mobile,Cloud andautomation,ontopofthemore their needs, the needs of their banks in terms of onboarding and the needs of the increase their strategic prosaic improvements in payments infrastructure and bank connectivity, do various different suppliers of capital and insurance to this market. Most of all they represent the drivers of a treasury revolution. Only a treasury able to support need to be able to map their own operations and objectives onto this complex value to thebusiness. businesses themselves adopting new digital strategies will be fit for purpose. So ecosystem of suppliers, to understand the specific costs and benefits that an SCF what does a transformed treasury look like? How can treasurers translate programme will generate for them. This company realised that a successful SCF consultant-speak into a series of achievable, cost-effective objectives? This implementation would significantly enhance their working capital and opted to for treasurer explains what they mean by transformation and what they have found is an integrated package that included automation of invoices and payment, invoice possible. They reveal how the department made the business case for change at a discount management, procurement and supplier-initiated early payment. In this time when budgets are tight and how the resulting investments in key systems, presentation theyexplainthechoicestheymade. along with strategic reviews of its in-house and SSC structures, really have made a significant difference. 4.40 BESTATWORKINGCAPITALMANAGEMENT 12:40 LUNCH How can companies shorten entire whole cash conversion cycle to generate 2:00 BESTATREMOVINGTHEPAINFROMGLOBALCASH maximum liquidity without harming t business efficiency and supplier and customer relations? The answer is total treasury optimization: the payment cycle must be Global cash visibility is still one of treasurers’ key concerns. For multinational extendedwithoutdamaging supplychains;thereceivables cyclemustbeshortened; companieswithcomplexbusiness structures andmanyhundredsofbankaccounts, inventory levels must fall and innovative inventory financing options explored; beingconfidentthat cashandliquidity reportsareaccurateiscritical, butachieving receivables financing programmes from whole-book securitization to simple that goal has proved problematic. However, without visibility, treasurers cannot receivables purchase facilities must be evaluated. And that is in addition to all the adequately control and mobilise group cash, create usable forecasts, manage FX standard treasury optimizations around banking, cash management and the use of risk or maximize returns from excess cash. Treasury technology has long been in-house banks, POBO/ROBOstructures andsharedservicecenters. heralded as the answer to these problems, but the costs and complexity of 5:20 ADJOURN TO DAY3 implementationhavebeensignificant barriers,especially formid-sized firms. Smaller firms struggle with spreadsheets and downloads from different single bank portals to manually build up a picture of the company’s cash; larger firms wrestle with legacy systems and multiple TMS and ERP implementations. But there are solutions. In this case study, learn how this treasurer has used new treasury technologytodelivermeasurableoperational improvements.Andseehowtreasury technology can help treasury teams move from an operational role to a strategic role within theirorganization. Dayna Padgett, Treasury Manager, JDA Software Group, Inc., US Warren Davey, EVP, GTreasury,US 17

The Intelligent Treasury | EuroFinance | The Economist Group Page 16 Page 18

The Intelligent Treasury | EuroFinance | The Economist Group Page 16 Page 18