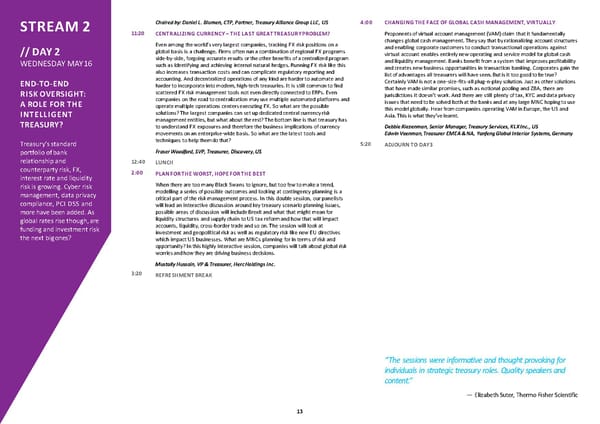

STREAM2 Chairedby: DanielL.Blumen,CTP,Partner,Treasury Alliance Group LLC, US 4:00 CHANGINGTHEFACEOFGLOBALCASHMANAGEMENT,VIRTUALLY 11:20 CENTRALIZINGCURRENCY–THELASTGREATTREASURYPROBLEM? Proponents of virtual account management (VAM) claim that it fundamentally Even among the world’s very largest companies, tracking FX risk positions on a changes global cashmanagement.Theysaythatbyrationalizing accountstructures // DAY 2 global basis is a challenge. Firms often run a combination of regional FX programs and enabling corporate customers to conduct transactional operations against side-by-side, forgoing accurate results or theother benefits of a centralized program virtual account enables entirely new operating and service model for global cash WEDNESDAY MAY16 such as identifying and achieving internal natural hedges. Running FX risk like this and liquidity management. Banks benefit from a system that improves profitability also increases transaction costs and can complicate regulatory reporting and and creates new business opportunities in transaction banking. Corporates gain the accounting. And decentralized operations of any kind are harder to automate and list of advantagesall treasurers will have seen.Butisittoogoodtobetrue? END-TO-END harder to incorporate into modern, high-tech treasuries. It is still common to find CertainlyVAMisnotaone-size-fits-allplug-n-playsolution. Just asothersolutions RISKOVERSIGHT: scattered FX risk management tools not even directly connected to ERPs. Even that have made similar promises, such as notional pooling and ZBA, there are companies on the road to centralization may use multiple automated platforms and jurisdictions it doesn’t work. And there are still plenty of tax, KYC and data privacy A ROLE FOR THE operate multiple operations centers executing FX. So what are the possible issuesthatneedtobesolvedbothatthebanksandatanylargeMNChopingtouse INTELLIGENT solutions? The largest companies can set up dedicated central currency risk this model globally. Hear from companies operating VAM in Europe, the US and managemententities,butwhatabouttherest?Thebottomlineisthattreasury has Asia.Thisiswhatthey’velearnt. TREASURY? to understand FX exposures and therefore the business implications of currency Debbie Riezenman, Senior Manager, Treasury Services, KLXInc., US movements on an enterprise-wide basis. So what are the latest tools and Edwin Veenman, Treasurer EMEA &NA, Yanfeng Global Interior Systems, Germany Treasury’s standard techniques to help themdo that? 5:20 ADJOURN TO DAY3 portfolio of bank Fraser Woodford, SVP, Treasurer, Discovery,US relationship and 12:40 LUNCH counterparty risk, FX, 2:00 PLANFORTHEWORST,HOPEFORTHEBEST interest rate and liquidity risk is growing. Cyber risk When there are too many Black Swans to ignore, but too few to make a trend, management, data privacy modelling a series of possible outcomes and looking at contingency planning is a compliance, PCI DSS and critical part of the risk management process. In this double session, our panelists will lead an interactive discussion around key treasury scenario planning issues, more have been added. As possible areas of discussion will include Brexit and what that might mean for globalratesrisethough,are liquidity structures and supply chain to US tax reform and how that will impact funding and investment risk accounts, liquidity, cross-border trade and so on. The session will look at the next bigones? investment and geopolitical risk as well as regulatory risk like new EU directives which impact US businesses. What are MNCs planning for in terms of risk and opportunity?Inthis highly interactive session, companies will talkabout global risk worriesandhowtheyaredrivingbusiness decisions. Mustally Hussain, VP&Treasurer,HercHoldings Inc. 3:20 REFRESHMENTBREAK “The sessions were informative and thought provoking for individuals in strategic treasury roles. Quality speakers and content.” —ElizabethSuter,ThermoFisherScientific 13

The Intelligent Treasury | EuroFinance | The Economist Group Page 12 Page 14

The Intelligent Treasury | EuroFinance | The Economist Group Page 12 Page 14