Pre-Conferencing Training

Cash Flow Forecast

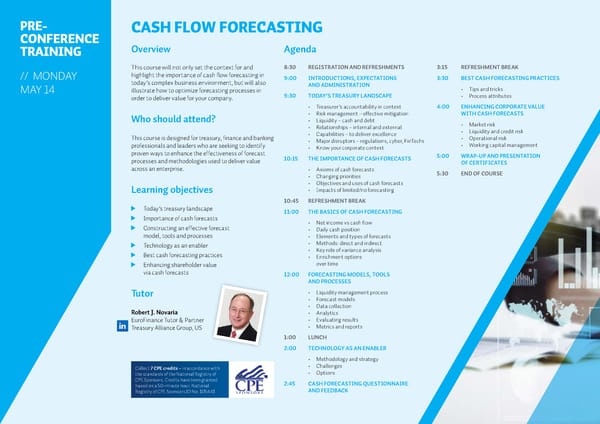

PRE- CASH FLOW FORECASTING CONFERENCE TRAINING Overview Agenda This course will not only set the context for and 8:30 REGISTRATION AND REFRESHMENTS 3:15 RE FRESHMENT BREAK // MONDAY highlight the importance of cash flow forecasting in 9:00 INTRODUCTIONS, EXPECTATIONS 3:30 BEST CASH FORECASTING PRACTICES today’s complex business environment, but will also AND ADMINISTRATION MAY 14 illustrate how to optimize forecasting processes in • Tips and tricks order to deliver value for your company. 9:30 TODAY’S TREASURY LANDSCAPE • Process attributes • Treasurer’s accountability in context 4:00 ENHANCING CORPORATE VALUE Who should attend? • Risk management – effective mitigation WITH CASH FORECASTS • Liquidity – cash and debt • Market risk • Relationships – internal and external • Liquidity and credit risk This course is designed for treasury, finance and banking • Capabilities – to deliver excellence • Operational risk professionals and leaders who are seeking to identify • Major disruptors – regulations, cyber, FinTechs • Working capital management • Know your corporate context proven ways to enhance the effectiveness of forecast 10:15 THE IMPORTANCE OF CASH FORECASTS 5:00 WRAP-UP AND PRESENTATION processes and methodologies used to deliver value OF CERTIFICATES across an enterprise. • Axioms of cash forecasts 5:30 END OF COURSE • Changing priorities • Objectives and uses of cash forecasts Learning objectives • Impacts of limited/no forecasting 10:45 REFRESHMENT BREAK Today’s treasury landscape 11:00 THE BASICS OF CASH FORECASTING Importance of cash forecasts • Net income vs cash flow Constructing an effective forecast • Daily cash position model, tools and processes • Elements and types of forecasts Technology as an enabler • Methods: direct and indirect Best cash forecasting practices • Key role of variance analysis • Enrichment options Enhancing shareholder value over time via cash forecasts 12:00 FORECASTING MODELS, TOOLS AND PROCESSES Tutor • Liquidity management process • Forecast models • Data collection Robert J. Novaria • Analytics EuroFinance Tutor & Partner • Evaluating results Treasury Alliance Group, US • Metrics and reports 1:00 LUNCH 2:00 TECHNOLOGY AS AN ENABLER • Methodology and strategy Collect 7 CPE credits – in accordance with • Challenges the standards of the National Registry of • Options CPE Sponsors. Credits have been granted 2:45 CASH FORECASTING QUESTIONNAIRE based on a 50-minute hour. National AND FEEDBACK Registry of CPE Sponsors ID No. 105441